EU Sales Reports for VirtueMart

EU-based businesses selling to other businesses providing a valid EU VAT ID do not have to charge VAT for these sales ("reverse charge"). However, merchants regularly have to report those untaxed sales by submitting a list of VAT IDs and the total order amount for each VAT ID in the so-called EU Sales report or EU Recapitulative Statement.

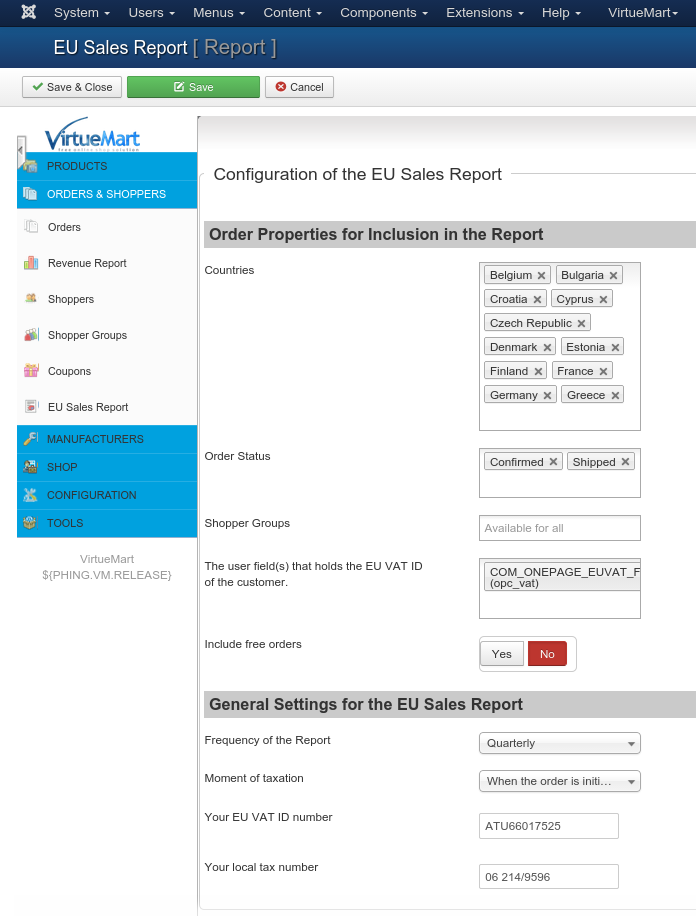

This component helps extracting and exporting this list. After installation, it is available in the VirtueMart Backend under the menu "Orders & Shoppers" => "EU Sales Report".

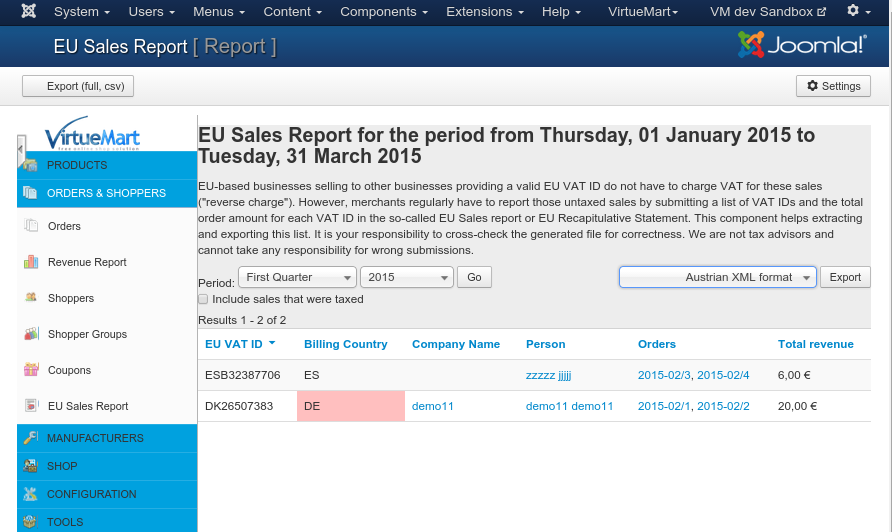

All sales in the selected period (month/quarter/year) to a customer who submitted a EU VAT ID are listed, together with the order totals and links to the customer and the orders. Some tax authorities have dedicated file formats for submitting those EU Sales reports electronically. Currently available export formats in the extension are the Austrian XML, the German CSV and a generic CSV format containing all information.

By default, only untaxed orders are shown and exported, because the report regards only orders with reverse charge. You can, however, also include orders with a given VAT ID, where tax was charged (probably by mistake) to identify possible misconfigurations.

Additionally, orders where the VAT ID does not match the billing country are marked, too.

It is your responsibility to cross-check the generated file for correctness. We are not tax advisors and cannot take any responsibility for wrong submissions.

Further information about the export formats:

- Austrian XML format (for FinanzOnline): Informationen des BMF für Softwareherstelle zur Zusammenfassenden Meldung

- German CSV format (for ElsterOnline): CSV-Format der Import-Datei im BZSt-Verfahren Zusammenfassende Meldung (Stand 29.6.2011)

License

This plugin is licensed under the GPL v3+ and can be downloaded and used free of charge.

Source Code and Contributing

The source code of this plugin is managed using git and a GitHub repository: https://github.com/open-tools/vm_eu_recap

To contribute to the project, feel free to send me patches or pull requests for this GitHub repository.

Version History

2016-11-12: Version 0.8 (Fix changed function signature in VmController)

2016-08-09: Version 0.7 (Fix the export button breaking all other form controls)

2016-07-30: Version 0.6 (Prevent JS from being included in the export)

2016-04-02: Version 0.5 (Update to changed VM core)

2016-01-01: Version 0.4 (Add automatic updates, round amounts for Austrian XML)

2015-04-09: Version 0.3 (First public release)

2015-03-08: Version 0.1 (Initial test release)